How to trade step by step

Online trading has become one of the most popular forms of investment thanks to its accessibility and the variety of markets available. Learning how to trade does not require you to be an expert from the outset, but it does require clear guidance and reliable tools to help you make good decisions.

The first step is to open a free account on a trusted platform. Once you're in, you can choose the market you want to invest in, whether it's Forex, cryptocurrencies, commodities, indices, or stocks. The next step is to define your strategy, decide whether you're going to open long or short positions, and set stop-loss levels to protect your capital.

With our intuitive platform, you'll have access to trading signals, real-time analysis, and advanced tools, allowing you to trade with confidence and speed.

Remember: trading is not about guessing, but about managing risk, taking advantage of opportunities, and following expert traders who already have experience in the markets.

Ready to start your trading journey?

Create a trading plan and level up

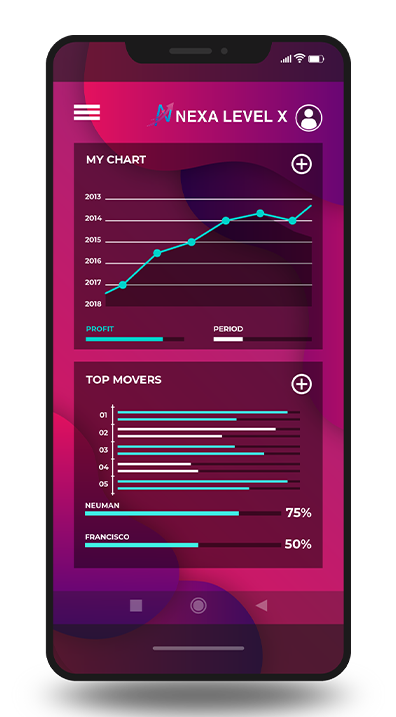

Tips for creating your first trading plan on Nexa Level X

A well-defined trading plan will help you stay focused and disciplined, reducing the risk of making emotionally driven decisions. With a clear plan, you can manage risk, improve your consistency, and increase your chances of success.

Your trading plan on Nexa Level X should include:

- Markets you want to trade

- Trading strategy with clear entry and exit criteria

- Risk management structure

- And other key elements that give you confidence and control in each trade

Designing a plan is not just a recommendation, but the foundation of any successful trader. The more detailed and realistic your plan is, the more prepared you will be to take advantage of market opportunities.

Find traders that are right for you

With us, you have the opportunity to choose from proven traders with many years of experience in the financial world and extensive knowledge of the markets.

You don’t have to risk your money by making blind decisions: simply follow the professionals and copy them.

With a lower initial investment than traditional markets such as Wall Street require, the Nexa Level X market may be ideal for traders looking to trade intraday positions with flexibility, security, and global access.

Define your risk management strategy

Effective risk management often makes the difference between success and failure, as well as helping reduce stress while trading.

Defining how to trade without jeopardizing your lifestyle, savings, or retirement involves understanding key factors such as diversification.

It is also essential to keep up with an ever-changing market that is sensitive to both big news and small movements. Having tools that allow traders to predefine targets and stops to close a position is just one practical example of risk management in action.

Traders in a bear market environment often use short trades to make profits.

Discipline and patience determine your ability to follow a trading plan

In trading with Nexa Level X, as in any profession, it is essential to be aware of the role that psychology and behavior play in your success or failure.

As markets change, traders must adapt their decisions with reason and strategy, rather than being driven by emotions or impulses.

Developing this technical mindset as a Nexa Level X trader is key to gaining experience and improving your vision of how to trade consistently and professionally.